This content is adapted from a Scott Adams presentation and his best-selling book How to Fail at Everything and Still Win Big: Kind of the Story of my Life. I’ve been an avid follower on Periscope, YouTube, and now on Locals. After following Scott for so long, I now realize I have unwittingly done these three things in my life.

I’ve read this book numerous time. I like it, because it related to me. You see, I have been a tremendous failure in life. I had chronic strep throat in grade school. I was small for my grade, so I was picked on in middle school. I almost flunked out of college trying to fit in with the party crowd.

Later in life, I did many jobs before settling in to my my current career. I have even started several businesses. You might say failure is a common theme in my life.

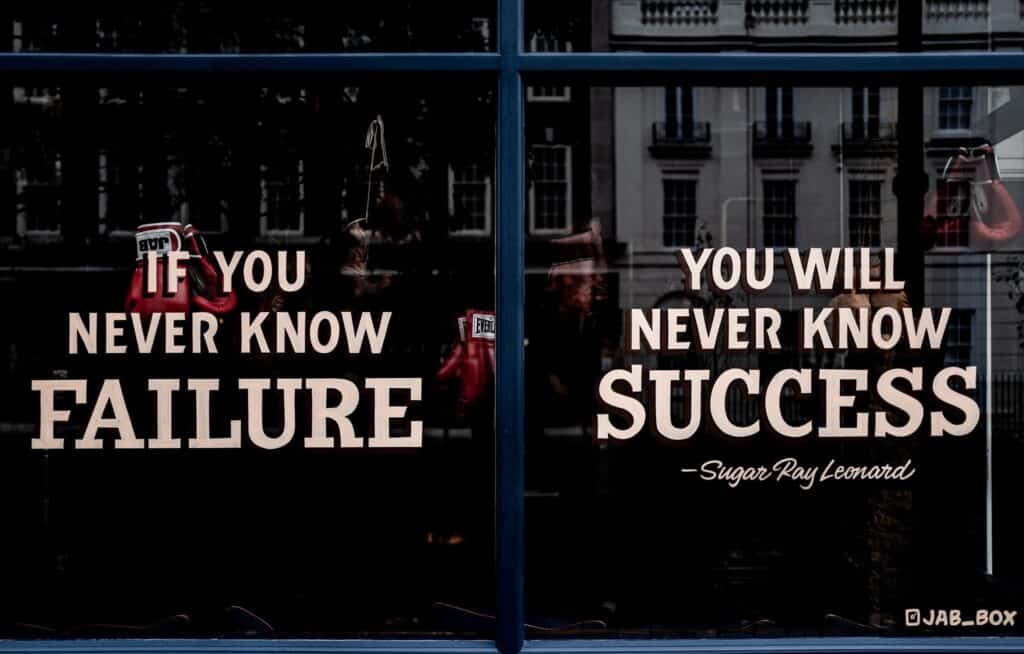

But I am thankful, because failure shaped who I am. Failure helped me develop coping skills. I had smart loving parents and good teachers who let me fail. So I was forced to learn from my mistakes.

1. Goals are for Losers

The problem with goals is that life is way more complicated than it used to be. Scott Adams writes that goals are like shooting an arrow in the fog. If enough horsemen shoot enough arrows in the fog, someone will inevitably hit their target. But most will miss. But one lucky archer gets a book deal and says he owes his success to having a goal. Those who miss are viewed as goalless losers.

Little did I know that I had a system. Every time I failed, I learned something. Systems are far better than goals for moving forward in the world. Systems greatly increase the likelihood of success.

Scott also writes that complementary skills improve odds of winning. He coined the term skill stack. For example, adding the skill of public speaking to his being an author has greatly improved his bottom line.

How is this related to personal finance?

Systems can include things like automating 403(b) and Roth IRA contributions. I have a system for my asset allocation, our personal finances, my weekly schedule, and exercising.

Every Friday morning, I balance all our deposit accounts, oversee transfers, make sure bills are paid, and (of course) schedule my Friday blog post.

Every Sunday night, I add another sheet to my ideal week workbook file in Excel.

At the beginning of every month, we have a family budget committee meeting to look at the upcoming month’s budget.

We also evaluate how the previous month went, and we do some long-term planning using our big-ass calendar. (Jesse Itzler seems like he’d be an amazing coach, but I just bought the calendar.)

But the power of habit is hard to break once you have been doing these things long enough.

2. Passion is Overrated

When you read about billionaires like Warren Buffett, Richard Branson, or Mark Zuckerberg, they all say passion was the key to their success. Scott questions this. What else could they say? That they’re smarter than poor people? That would be jerky. Or that they work harder than poor people? That would be presumptuous. That they got lucky? That takes away from the mystique of success.

These individuals have all had media training, and they know what they can say publicly that doesn’t harm their brand.

Think about the individuals who compete in American Idol. They all have passion, yet only the final dozen or so have the chops to succeed commercially. The first few episodes of the TV program showcase stadiums full of passionate people who suck at singing!

How is this related to personal finance?

It turns out that passion follows success, not the other way around. My wife and I are passionate about personal finance and helping others, because we experienced success through hard work and behavior modification. To hear Scott Adams story, he wasn’t always passionate about cartooning… until after years of toiling, continually creating, and personal networking made him rich!

3. Luck Can Be Manipulated

While luck cannot be created, Scott says that we can definitely go to where luck is more likely to happen. Getting lucky is like getting struck by lightning. Imagine there is a thunderstorm. If you went to the top of a mountain and held up two golf clubs in the middle of a storm, would you increase your likelihood of being struck by lightning? You betcha! Although being struck by lightening is unlikely, we can definitely increase the odds…

Similarly, if you go to where successful things go on, odds are greatly improved. That’s why actors go to Hollywood, country singers go to Nashville, and investment bankers go to New York City.

How does this relate to personal finances?

The harder we worked at eliminating debt, saving for a rainy day, and investing, the luckier we seemed to get. Time goes by so fast… But after over a decade of doing the things that other wealthy people do, we have unwittingly adopted a lifestyle that never would have seemed possible to me in my 30’s. So now in my 50’s, I am passionate about the personal finance game and helping others who were where I was when we started our journey.

As always…

Thank you for reading, and allowing me to try something a little different today. Dave Ramsey always that winning with money is just 20% head knowledge and 80% behavior.

This article was aimed more at behaviors than the specifics of the debt snowballs, emergency funds, and asset allocations.

If you want to connect, shoot me an email to mark@marknoldy.com. If you have a specific question, you can send it to questions@marknoldy.com.

Or just sign up below.

Enjoy your weekend!