An emailer asks, “what is the safest and easiest way to invest?” A great question with many great answers and even more opinions. So keep in mind that this is for educational purposes only. I’m not recommending anything, just sharing what I do based on what I have learned.

Debt-Free

The first thing we did was to make sure we were living debt-free (except for our house). Your income is your biggest wealth-building tool. It can’t be used for investing if Visa and MasterCard already have their hooks into it. So debt-free living comes first.

No doubt some will swing for the fences by gambling more borrowed money on crypto or something else they know nothing about. A few have gotten lucky, but most end up digging the hole deeper. When trying to get out of a deep hole, put the shovel down first.

Mutual Funds

Mutual Funds are one of the safest investments that exceed inflation and taxes. The reason mutual funds are considered safe is called diversification. A mutual fund consists of many underlying stocks and/or bonds. Because mutual funds are actively managed, investors may pay high expense ratios. And these expenses are paid to the manager(s) whether or not the fund even made any gains.

The drawback is that a substantial initial investment is often required. One way around this can be to set up a company-sponsored 401k or 403b with regular investments from every pay check.

Enter Index Funds

Back in 1974, Vanguard’s Jack Bogle created the first index fund. Like mutual funds, index funds consist of many stocks and/or bonds. But these are designed to mirror some index like the S&P 500 or some market sector like technology. As such, they are passively managed making for very low expense ratios. For example VFIAX (Vanguard’s S&P 500 index fund) has a super low 0.04% expense ratio. That just $4 per $10000 invested.

However, like mutual funds, a sizable upfront investment is often required. VFIAX is $3000 unless set up through an employer-sponsored program.

ETFs

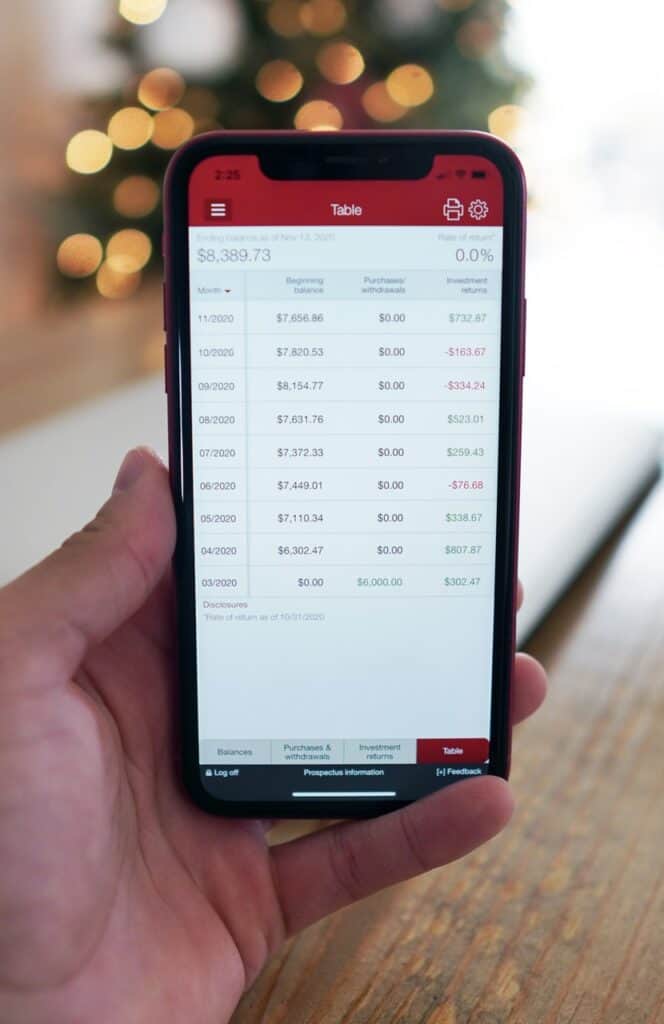

Then in the 1990s, exchange-traded funds, or ETFs, were created. ETFs share the diversification of mutual funds and index funds. But you can invest starting with a single share. When using an app like M1 Finance, you can actually invest in fractions of shares. (I may start making videos of how to use this.)

VOO is one of many ETFs that mirror the S&P 500. I’m partial to Vanguard’s ETFs because they have one of the best selections. Only Blackrock has more, but they both have sector ETFs, international ETFs, bond ETFs, and so on. There is basically an ETF for each index fund.

Another difference from mutual funds is that ETFs are traded on the stock exchange throughout the day. The prices vary just like an individual company’s stock. When we invest in a mutual fund (includes index funds), the price is determined at the end of the trading day.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, call me and leave a message or send a text to 570-731-0425.