Happy April Fool’s Day! Today is the day when we spreadsheet nerds analyze the March “budget” against the March “actual.” For me, it is also a day to update the net worth tracker. Remember that net worth is how we keep score of our money game.

First things first

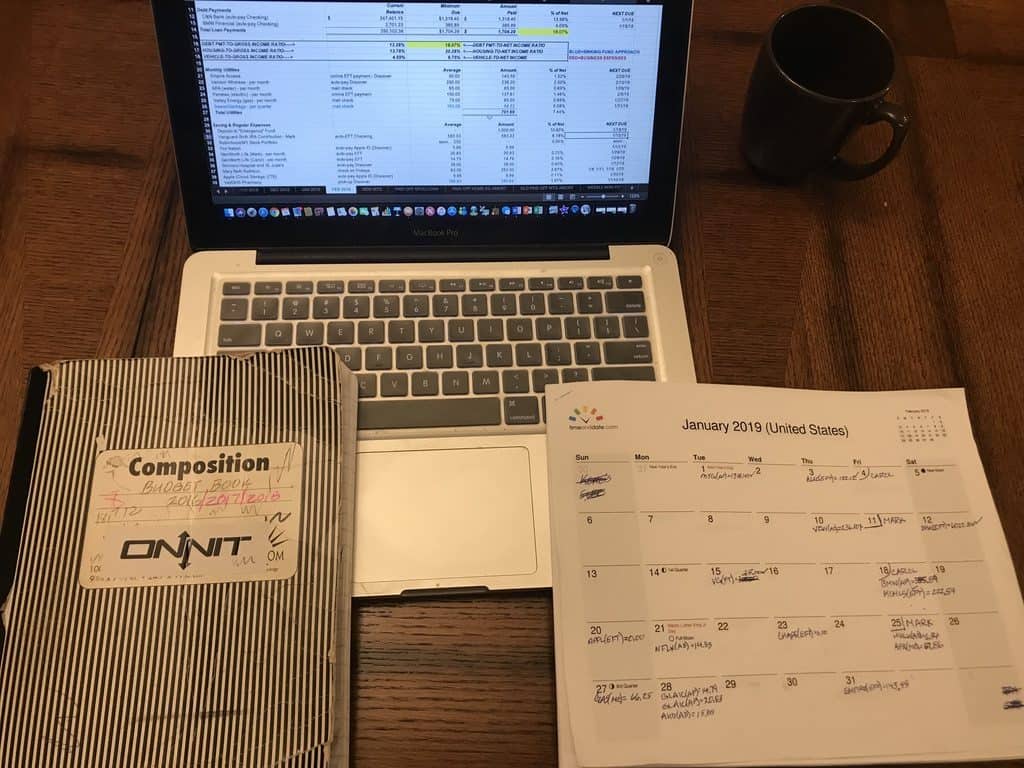

I grab everything I need. Payment calendar. Black Book. Laptop. For good measure, I keep a calculator handy — usually my iPhone — because I can use apps to check balances.

As actual payments have come in, I was updating our budget spreadsheet. I scan the spreadsheet for omission and errors. I track the percentage of net income for major expense categories. In particular, I check the following to ensure they are within our budgeted guidelines:

- housing to net income,

- utilities to net income, and

- vehicle to net income.

Additionally, I check total debt ratio and liquidity ratio. Banks care about an individuals total debt to asset ratio. We care about our liquidity ratio. This measure tells us how many months we can go with no income.

After the “actuals” are verified with our payment calendar, I have the exact March weekly “cash flow” amount. This is what would be going into envelopes if we used the envelope system.

We have a close idea going into the month. But since Carol’s pay varies depending on the final number of hours worked each pay period, we finalize this after her last pay for the month.

Over to the black book

Now that I’m happy with the spreadsheet, I copy our final “weekly” cash flow budget amount over to each Friday of March in the black book. Cash flow items (i.e., envelope stuff) is totaled at the end of each week.

Now I subtract the weekly cash-flowed amount from each week’s total. Usually we are “under,” but sometimes we go over due to unexpected expenses. For instance, this month saw unexpected cash flow items for pet care. (Sadly, we had to put our Sophie Mae to sleep this month.)

Sophie Mae

12-8-2013 to 3-21-2019

Back over to the net worth tracker

Sorry for that, but ever dollar is tracked. Next, I add any interest credit in the check book, savings, and money market registers. After calculating present balances as of 03/31/2019, I enter them into the balance sheet portion of our net worth tracker.

Now it’s time to look up balances as of 03/31/2019 for investment accounts. After entering them, I have our current net worth. Remember, that’s just total assets minus total liabilities.

The long-term goal is to reach millionaire status. Beyond the territory of financial peace lies the land of financial independence. This is where our money earns more than we do. Then ride off into the sunset! Or something like that. Our sunset is waking to sunrises in our beach condo in South Carolina.

More this month on Dream Meetings.