So I was lecturing in my classroom when a student asked a question about how many people I thought actually did a budget. I said that I wasn’t sure what the latest data was saying. About 5 years ago I knew it was low.

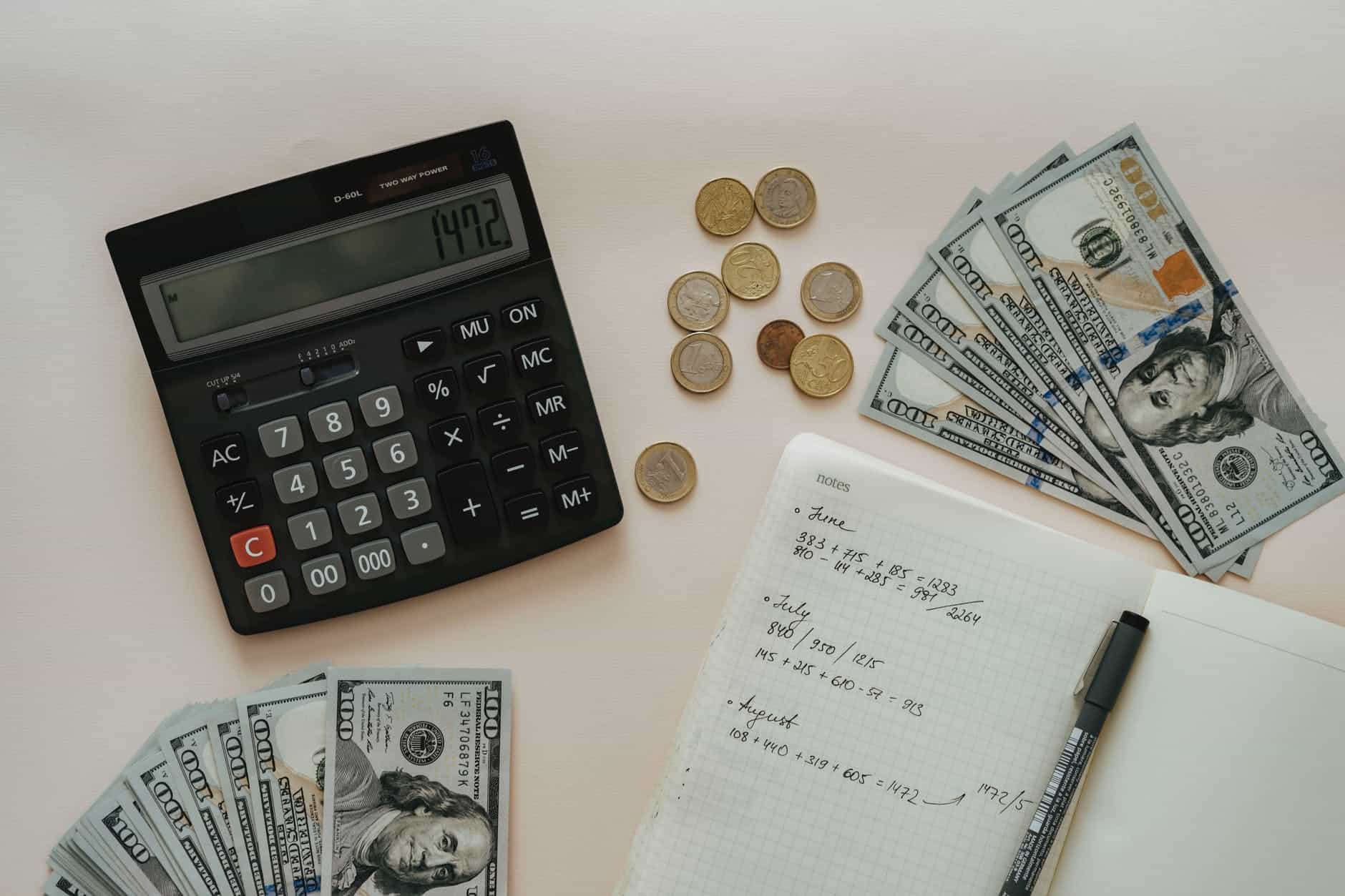

According to a 2021 survey by debt.com of over 1000 Americans, 80% of people say that they budget. This is up from 68% based on a poll they did two years ago. However, CNBC report says that 61% of Americans were still living paycheck to paycheck in 2021 despite rising wages. This doesn’t track for me. Making a budget is a powerful personal finance tool.

What makes a budget a budget?

I have always been of the belief that a budget wasn’t a budget unless it was written (and followed!). It’s kinda how a diet isn’t a diet unless macros, calories, feeding times, etc. aren’t planned and tracked. When I started using My Fitness Pal, I realized how much extra food I was eating. I went from, “I didn’t eat too much junk food today,” to “I ate like a glutinous animal today.”

In my classroom, I frequently make the analogy between winning with money and a fitness-and-nutrition lifestyle. Both require sacrifice, and documentation helps keep us on track. The road to Awesome is not as easily traveled as the road to Average.

At any rate, the budget must be written and codified to be useful. And you won’t be great at it the first month. As I recall, it took us 3-6 months to feel like we really had a handle on this budget thing.

How often should people budget?

Budgeting is an acquired skill and you have to practice it regularly to get better at it. (Hey, that’s kinda like math.) Therefore, the cash flow plan should be done every month. Spend every dollar on paper on purpose at the beginning of every month. As your comfort level improves, so will you skill level.

Doing the budget is the equivalent of the daily problem set from back in your high school algebra class. The student who do the assignments do the best on exams.

Similarly, the grown-ups who do a budget do the best at wealth building and avoiding debt.

Who should budget?

Every person or family with an income should budget. If you don’t tell your money where to go, you may end up wondering where it went! The budget is our game plan for the month. When we spend our dollars on paper on purpose at the beginning of the month, we ensure that there is surplus for debt servicing and/or investing. (Sorry if this sounds repetitive, but repetition is the mother of all learning.)

What prompts most people to start budgeting?

Many people start budgeting as a result of a crisis. This crisis can be that they need to save enough for retirement, that they need to eliminate debt, that they lost a job, or that they had a divorce.

That last thing was the reason for me. Never again was money going to control me. I vowed to learn how to control it with a monthly budget, and it has evolved over the past 13 years. Yes! I have a 13 year old Excel workbook that I still use each month!

In any event, evolutionary psychologist Dr. David Buss says that adults change behaviors when they experience massive trauma. That’s maybe why some people don’t lay off the twinkies and mix in a salad until after the first heart attack.

How do people budget?

Most people in the survey said that they used pencil and paper. I’m not sure I believe this. Maybe I’m projecting, because I use an Excel workbook. Then again, I’m a huge spreadsheet nerd and have a degree in finance.

If you’re not into spreadsheets, there are several websites with accompanying mobile apps out there. Two popular choices are YNAB (You Need A Budget) and Every Dollar (from Ramsey Solutions). If you totally don’t know where to start, both these solutions can help you get started. They provide prompts so that you don’t overlook budget items.

Interestingly, many people say they just hire a financial advisor. But that can be expensive which is probably why so many financial coaches (like me!) are helping people get started. Budget spreadsheets are fun for me, and I love teaching others how to get started with them.

Should you budget for special events and holidays?

Saving up for a vacation and Christmas shopping are two obvious reasons to build a little extra saving into the monthly budget. Vacation memories are much sweeter when they’re not accompanied by a huge credit card bill that stays with us until the next vacation. That goes for giving Christmas gifts as well.

The sinking fund approach can be used for big ticket items and should also go into a monthly budget. Items like property taxes and auto insurance are in my budget. Some people might even earmark a small amount every month for years in advance for a future car purchase.

So why doesn’t everyone budget?

Even though it isn’t listed, the budget really is Step Zero of any personal finance plan. It doesn’t matter if you’re using Dave Ramsey’s 7 Baby Steps, or Brian Preston’s Financial Order of Operations, the budget is what tells us how much surplus we have to put toward debt elimination and wealth building.

A main reason stated for not budgeting is a lack of money. What? If ever there was a person who needed to budget, it’s a person with limited (or sporadic) income. That’s like saying I’m not dieting, because it’s not Monday. As though only fit can people can follow proper diet…

Budgeting works when you work. Share on XThis also reminds me of a myth that rich people (those with high incomes) are the only ones who need to do budgeting. The irony is that high income folks can also be living paycheck to paycheck. Lifestyle creep just makes them broke on a bigger scale.

Another startling reason given was that budgeting didn’t work for them. “I’ve tried budgeting, and it didn’t work for me.” That reminds me of the person who says keto didn’t work for them. (Meanwhile, they did it for two days.) As would-be dieters have to reframe their dietary habits as a short-term sacrifice today for a way better tomorrow, budgeteers have to keep their eye on the prize. Don’t lose sight of the goal. That’s how the budget works. Dave Ramsey says if we live like no one else, later we’ll live like no one else.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, send an email to mark@marknoldy.com.