Although I feel better than I used to about my family’s financial standing, ne’er a day goes by that I don’t kick myself for not starting investing sooner. Someone once said that youth is wasted on the young, and wisdom is wasted on the old.

Don’t pout! While it’s impossible to instantly change your situation, it is possible to change your direction. The best time to plant a tree was 25 years ago. The second best time is today.

8th Wonder of the World

It is reputed that Albert Einstein referred to compound interest as the 8th wonder of the world.

[bctt tweet=”Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it. — Albert Einstein”

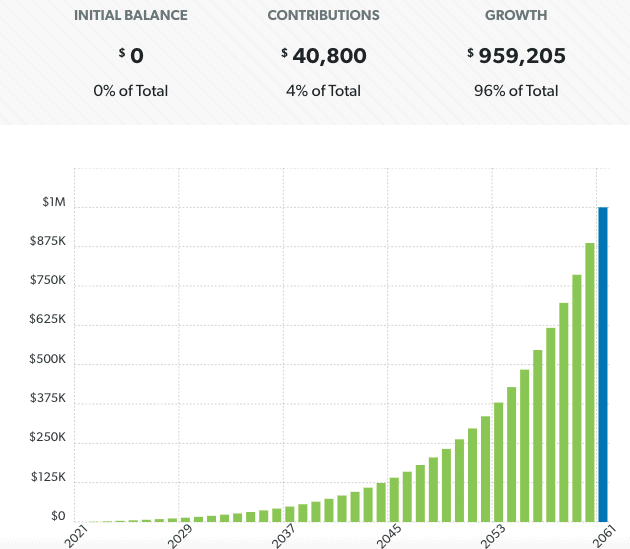

Regardless of who actually said it, what compound interest means is that you need to start investing early in life. Wisdom tells me that my 20-year old self could have been an IRA millionaire 4 years ago by investing just $85 a month. But my 20-year old self did not have my 54-year old wisdom. The younger you are, the less you need to invest to eventually achieve millionaire status.

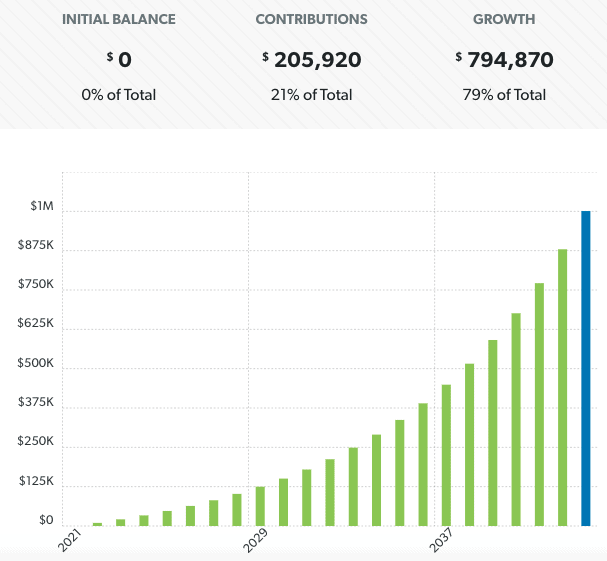

Waiting to start until age 38 morphs that $85 into $780 a month to be an IRA millionaire by age 60. That another $695!! I’m sure that 20-year old Mark thought he had everything under control when his parents urged better money management and saving for retirement!

Wanna get super crazy?

Maximizing a Roth IRA from 20 to 60 yields $5,901,472. That’s almost six million bucks!

So here is wisdom… If you’re 20, start investing! The 8th Wonder of the World needs time. And be patient. The most important personal characteristic of millionaires is delayed gratification.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, send an email to mark@marknoldy.com.