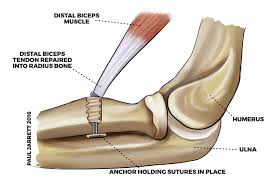

So I can type again… sort of. I recently had surgery to repair a ruptured distal biceps tendon. (That’s the one that goes into the radius forearm bone.)

I had my splint taken off and my stitches removed. But I’m still in a sling. The doc still wants me at 90 degrees so the bone continues to grow around the screw and button. And then I’ll have PT in a couple weeks. By Christmas, it should be good as new.

Now on with this week’s post!

Why is picking individual stocks so hard?

Warren Buffett has amassed a fortune picking companies. So why can’t I just read everything about him and be like him?

Let me borrow an analogy from JL Collins. You’ve heard of Muhammad Ali, right? Suppose you decided you wanted to be a legendary fighter like Ali. You’d train super hard, even hire a famous trainer like Ali’s Angelo Dundee. What are the odds you’d be as good as Ali? See where I’m going with this?

Some people may reason that they’ll just do what Warren Buffett did. But this fails to take into account his superior ability at analyzing individual companies. Like all superstars, Buffett is unique.

What can you do instead?

The easiest thing to do is to avoid picking individual stocks. Rather than betting on one company, bet on the whole market. As many of my readers know, my wife and I are predominately invested in VTSAX in both my tax-favored portfolios

VTSAX is Vanguard’s total stock market index, so it’s made up of about 3900 US companies. JL Collins likes that companies that perform poorly will eventually get phased out, so the fund is self-cleansing. Just set it and forget it. You’ve got better things to do with your time.

People who are just getting started can use the ETF, VTI, until they reach the $3,000 minimum investment required for VTSAX. VTI’s expense ratio is actually one basis point lower than VTSAX. But the difference between 0.03% and 0.04% is miniscule.

In any event, why pay someone 1% to 1.5% to manage your money. Depending on the timeframe, actively managed funds lose out to index funds anywhere from 80% to 85% of the time. Why pay 5000% more for active management when you can buy an index fund by yourself and beat these experts the vast majority of the time? And no one takes care of your money as good as you!

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, call me and leave a message or send a text to 570-731-0425.