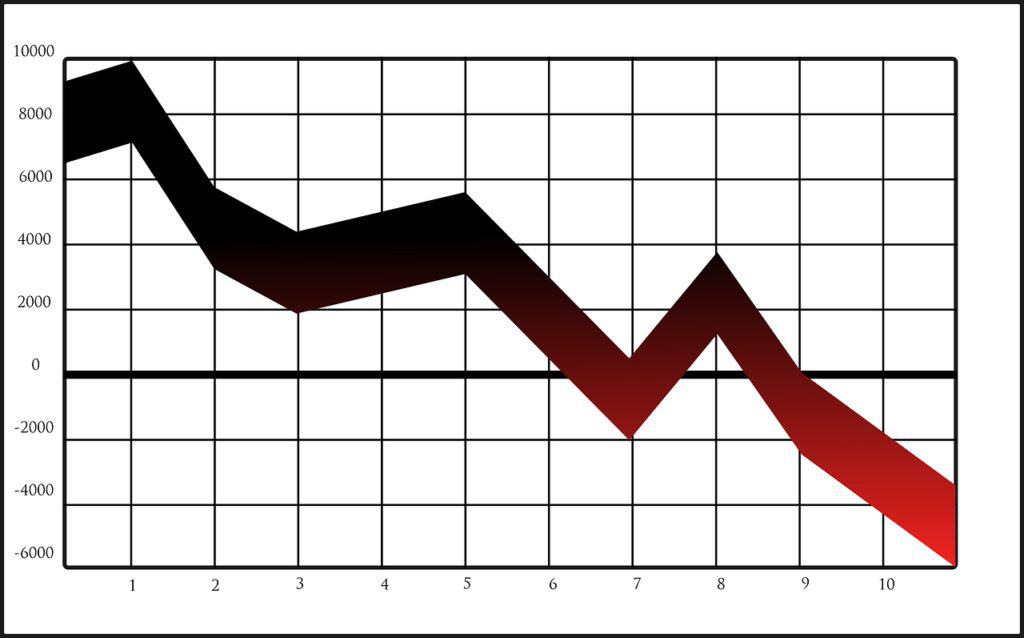

The Wall Street Journal reports that the economy contracted 1.4% the first quarter. That’s the worst since the pandemic started in the spring of 2020. And that contraction was short-lived.

Despite the reported shrinkage of GDP in the first quarter 2022, consumer spending increased at 2.7%. The economy still shows signs of resiliency with businesses investing up almost 10% more in the first quarter in equipment and research and development.

Why did the GDP dip?

The dip in GDP (Gross Domestic Product) is possibly the result of the increasing U.S. trade deficit. U.S. imports are flowing in even as dropped. This seems weird to me given the supply chain crisis. But in about a week, we’ll see what happened with GDP during the second quarter 2022.

I suppose consumer spending increases can be skewed by the pandemic lockdowns being lifted. Many of us developed a world-class case of cabin fever. As soon as we could, many of us went nuts with the new freedom.

But another dip this quarter would signal a recession.

Inflation

No can take a look at the economy without thinking of inflation. I’ve read that we are experience the high inflation levels since 1982. And in case we haven’t noticed, gasoline prices are also at all-time highs. For most of us, the entire basket of goods has gone through the roof. Eggs, bacon, milk, and other staples are

Interest Rates

So the Fed just increased rates by another 75 basis points last week. The 30-year mortgage rate has already almost doubled in the last year. Higher rates shouldn’t necessarily stop people from buying homes, because they can refinance in the future. And since home supply isn’t dropping, prices will probably stay elevated. So high home prices should not be a reason not to buy. I’m sure many will want to wait for rates to drop, but if they bought now, they could always refinance when rates do drop.

Jobs Market

The jobs market is still looking good. Unemployment was just 4.6% last month. However, there is still a labor shortage that can be a drag on GDP. This is due in part from the “great resignation.” The pandemic brought about our working remote. Many workers liked the flexibility of working from home. As a result, many are switching jobs. And as long as there are more jobs than there are people to fill them, I think people will continue to play musical chairs with their careers.

Supply Chain

Supply chain disruptions are not novel this past quarter. They started Rather, it seems to be an ongoing. Rising fuel costs have added expense to our basket of goods. Although many items in our basket are made stateside, the cost to get it to out stores has gone up.

Unrest in Ukraine

Continued unrest in Ukraine is definitely playing a role. I’m not certain what role that is. Unfortunately, POTUS has been blaming President Vladimir Putin for our country’s rising prices – the Putin price hike. Although it’s alliterative, the exact economic effect of the invasion of Ukraine may be unknowable until the end comes.

Misinformation Governance Board

This was a new initiative from the Department of Health and Human Services. It was probably a result of Elon Musk’s deal to acquire Twitter and take it private.

The head of this ministry of truth? Nina Jankowicz. This is the person who called the Hunter Biden laptop a Trump campaign product back in October of 2020. Of course, the laptop has since been acknowledged as truth, even by the New York Times.

In any event, the White House has put these plans temporarily on hold… I’m sure there will be more to come.

Open Border

Secretary Mayorkis hasn’t done much to stem the flow of illegal aliens at the southern border of the United States. I think most people assume that these are Mexican citizens flooding the labor markets. However, there is a general skilled labor shortage. And according to the Pew Research Center, less than half of all illegal aliens in the workforce in the US are Mexican.

Although I’m no expert, by all accounts the flow of illegal drugs has also reached epidemic levels. Many families have been touched by fentanyl poisoning. In fact, many famous entertainers who died from what was thought to be a drug overdose have now been determined to have died from fentanyl poisoning. The reason people have started calling it fentanyl poisoning is because the street drugs they thought they were buying were laced with fentanyl.

Pandemic

Last but not least, the pandemic has had many lasting effects on the economy. As mentioned above, I think that the lifting of lockdowns has led many people to “go bananas” from cabin fever.

But going back to the beginning of the lockdowns (March 2020), the economy had virtually ground to halt. Other than those who were considered essential workers, everyone was ordered to stay home. Depending on where people lived, this was strictly enforced. (Not so much for family-owned and operated businesses in rural America.) But if you were shopping for groceries or buying booze, just wear a mask.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, call me and leave a message or send a text to 570-731-0425.