When I was a child, I didn’t know it, but a lot of cartoon humor was over my head. In fact, much of it was indeed crafted for adults. Bullwinkle, Tom and Jerry, Bugs Bunny, etc.

Charlie Brown

One of my fondest childhood memories was watching the Charlie Brown specials on CBS. Now that I’m older, I get why the grown-ups in the Charlie Brown world sounded the way they did. “Wha wha wha, wha wha whaa.”

Grown-up speak can be confusing.

But like Keegan-Michael Key, I’m here to tell you, “You got this!”

There is so much terminology. Heck, I learn new words every day. But sometimes, doesn’t it seem that finance people are like computer geeks? They almost mock us for not knowing what (to them) is simple.

“Have you tried flashing the BIOS?” was a good one I heard years ago from a Dell phone rep. It has become an inside joke in my household. When no one knows what to do, we ask, “Have you tried flashing the BIOS?”

'Have you tried flashing the BIOS?' said my Dell rep. Click To TweetInvesting Fundamentals

Let’s start with the basics. DIY investing can seem intimidating. The most common investments for building long-term wealth are mutual funds and ETFs. The ETF combines the diversity of a mutual fund with the convenience and low barrier to entry of single stocks.

Charlie Brown words in the previous paragraph:

- DIY = Do-It-Yourself

- mutual fund = fund that is mutually held by the investors, consisting of a bunch of assets like stocks and bonds

- ETF = Exchange-Traded Funds… These are kinda like mutual funds except they are bought and sold in the regular stock market like the New York Stock Exchange and you don’t need a minimum investment of $3000 to get started.

- diversity = diversification means not putting all your eggs in one basket

Selecting Funds

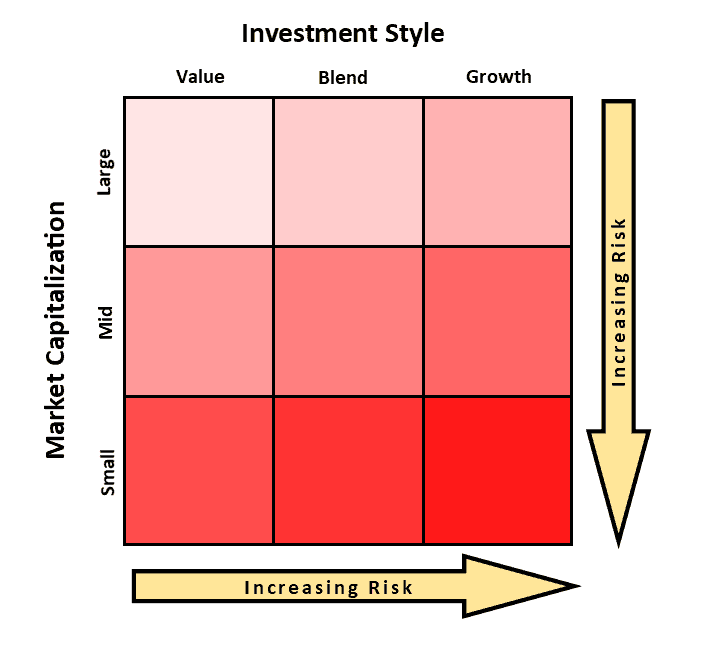

Whether choosing a mutual fund or ETFs, there are two aspects of the investment to keep in mind. Funds and individual equities can be described using the style box to the left. The vertical axis shows: large cap, medium cap, small cap. The horizontal axis shows: value, blend, growth.

Charlie Brown words in the previous paragraph:

- Style Box = tool used to categorize the risk of an investment

- Equities = another word for stocks

Market capitalization (cap for short) is talking about the size of the individual companies in the fund: small, medium, or large. Small-cap companies are often thought to be primed for growth, but they can be more risky. Medium caps may still be experiencing growing pains but also may have turned a corner as far as risk goes. Large cap are often older companies that have been around for a while. Think Coca-Cola.

Investment styles are called: value, blend, and growth. Value funds/stocks often include utilities like Verizon or AT&T and usually pay nice dividends. These are sometimes called income stocks. Jumping over to growth… These are companies that are predicted to grow. There may be no dividends as earnings may be getting re-invested in the company. And a blend is usually a combination of growth and income in a fund.

A fund I use that falls in the top center of the value box is VTI. This is Vanguard’s Total Stock Market ETF, a large-cap blend. (Vanguard’s mutual fund equivalent is VTSAX, but this requires a minimum $3000.)

Charlie Brown words in the previous three paragraphs:

- Capitalization = refers to the size of the company in terms of outstanding shares of stock being used to “capitalize” or fund the company’s activities

- Dividends = earnings that companies share with investors.

DIY becomes less confusing when you begin participating in the growth of the country’s companies. I first dipped my toe in the water with VOO. That’s Vanguard’s ETF that mirrors the S&P 500. Lower cost to enter than with VFIAX. When investors are talking about “the market,” they’re referring to the S&P 500.

I hope this short lesson is helpful if you are just getting started. My favorite resource for looking up things I am unsure of is Investopedia.

Any words you’re curious about? Shoot an email to me at mark@marknoldy.com, and I’ll write an article with your name in it!