I’m not sure where I first learned about this concept. But it is a useful concept in explaining where on the earning journey we are. In the interest of full disclosure, I did not invent the analogy of the four quarters of earning, but I have put my own spin on it.

Warm-up (age 18-25)

This is the time when the player sews wild oats as the saying goes. Although, many youth are way out in front of the game during the pre-game stage, most will be do one of four things:

- Taking a gap year (believe it or not, we learn a lot from intentional focus on watching the game),

- Entering college,

- Serving their country in the armed forces, or

- Entering the workforce.

Age 23 to 25 is for upward mobility, also known as job hopping, as the budding adult finds him- or herself.

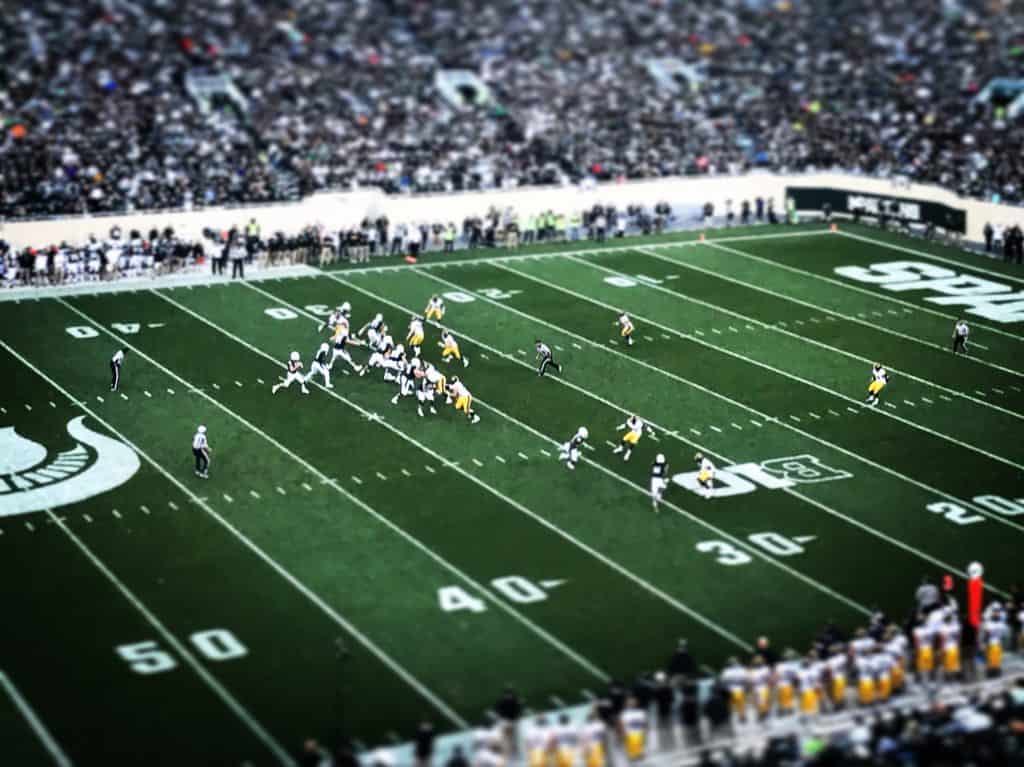

In the rest of the analogy, we equate our remaining 40 years of earning power, from age 25 to 65, as quarters in a football game. Each 10-year period is broken down into a quarter of the game.

1st Quarter (age 25-35)

In the first quarter, the players are still loosening up but may risk going for broke on a big play. Screwing up at this stage is not a catastrophic game killer. I was 26 when I decided to start my first business. Although it was only a moderate success (I give it a 6), I did almost a million in revenue in 6 years before selling it to teach. But I did learn many financial life lessons about cashflow management, but more importantly I became a better judge of character before entering the 2nd quarter.

2nd Quarter (age 35-45)

This is the age when many players are coming into their own professionally, but it is also when we hit some of the middle-age challenge. It is often related to a bad health report or relationship failure. For example, three years into my second quarter, my wife of 15 years left the straight life of working, paying bills, etc. She abandoned her marriage and children for a concert groupie lifestyle.

In any event, second quarter players tend to enjoy their work. Feeling like we’re part of a bigger cause can help. We are striving to have impact. When an individual loses that, a career change may not be far behind.

Halftime = Age 45

If you live to be 90, you’ll live 32,850 days (actually a little more with leap years). Not as many as you’d think, is it? The player is halfway there at age 45 as well as being halfway through the typical earning years. One of my favorite books is 20,000 Days and Counting: The Crash Course for Mastering Your Life by Robert D. Smith.

For the record I was 18,627 on my last birthday. I can see you looking up and to the left… I turned 51!

Update: I’m 55 now entering the 4th quarter.

3rd Quarter (age 45-55)

This may be a time for prayerful consideration about what we’ve accomplished and the legacy we plan to leave once we’re gone from this world. Will we leave a ding in the universe as Steve Jobs called it? Have we changed our family trees?

This may be the time some people enter the tunnel of a mid-life crisis. Assuming the player hasn’t had a health scare, this is a time for taking personal inventory. The healthy player makes adjustments. The highly neurotic player defaults to a mid-life crisis to address what may be full-blown cognitive dissonance. (The tell for cognitive dissonance is nonsense talk, a.k.a. word salad.)

4th Quarter (55-65)

Players are in in the home stretch. This is when the individual begins to worry whether they will have invested enough to retire. If they have been diligent in their planning, they may even be flirting with the idea of retiring early!

This may be the quarter to play catch-up. The IRS allows for larger investments in both the 401(k) and IRAs.

This is also a time of the passing of the guard. Did we blaze a trail in our careers? Will the way business is done change as a result of our works? With our legacies determined, we move into retirement.

Overtime? – aka, day of reckoning

Some football games need to go into overtime before the final outcome is known.

Some people are forced to play overtime. They may have to delay retirement until 67, 69, or even 75 because they “need” social security benefits to make ends meet. Other may be forced to be department store greeters, check-out clerks, retail store stockers, and so on.

Other people enjoy the overtime. That is, they continue to work, because they enjoy personal interaction with others, maintaining their mental acuity, etc. My mom is a classic example. She’s a “retired” RN who worked per diem until the age of 75. (And from what I hear, she out-hustled many of the younger ones!)

So based on the quarter you’re in and your financial situation, you have some decisions to make. Need help? Click here.