Although we know we all need insurance, who loves spending money year after year on premiums with nothing to show but a canceled check? But if you think about it, many monthly expenses leave us with nothing of value. Cable TV? Netflix? Mobile phone bill? And these examples are luxury items. That is they are wants as opposed to needs. Spend money on everything that’s important to you. But that’s why we need to…

1. Make a Budget

Knowing where your money is going is the best way to spend less than necessary on all your household expenses — both needs and wants. Monitoring expense ratios is critical. Minding these budget numbers helps people avoid being house-poor or car-poor or whatever.

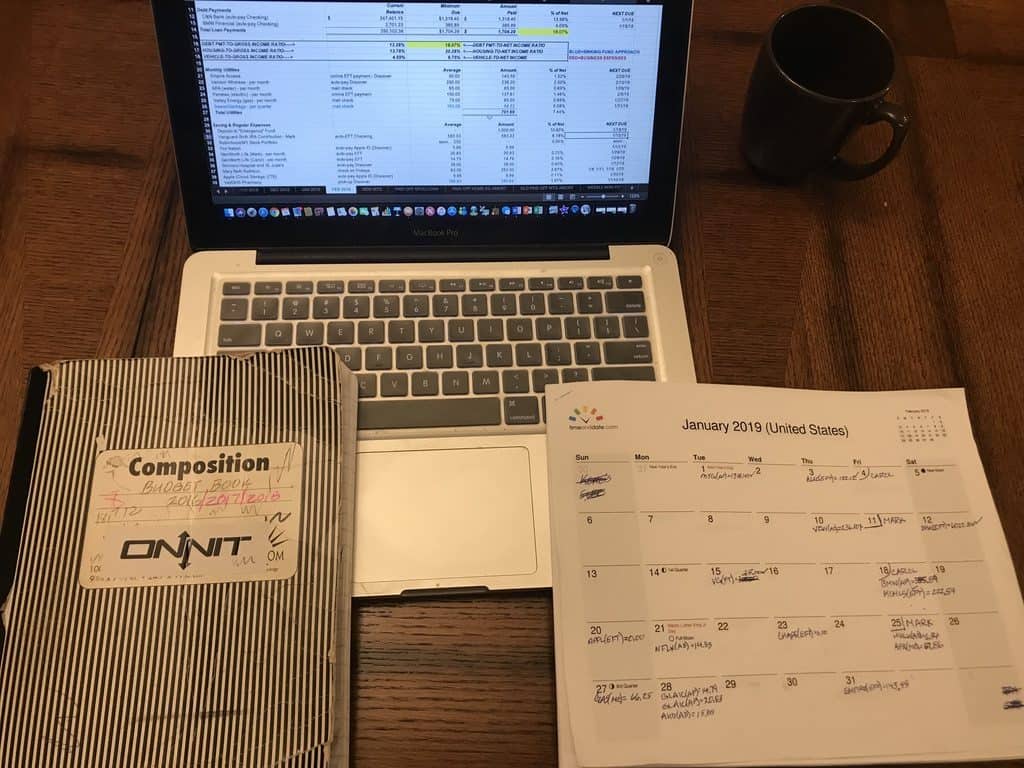

A budget is hard in the beginning, but everyone settles into it. All we use is a free annual calendar printed from timeanddate.com, a composition notebook ($0.50 at Dollar General), and an Excel workbook. We write our budgeted expenses on the calendar mostly for the visual. Our workbook has been honed over the years. This budget tells us our weekly cashflow. We don’t do envelopes. Expenses not in the monthly spreadsheet get written in the composition notebook, and we keep a running total each week. We also write the cumulative total for the year. We usually stay under our weekly cashflow number. When we go over occasionally, we don’t freak out since we keep a running total for the year as well.

2. Establish an Emergency Fund

The weird thing about emergency funds is that when you have one, emergencies seem to stop happening. The emergency fund is the first line of defense – a source of insurance that enables us to take advantage of other savings opportunities. An emergency fund turns major finance stresses into mere inconveniences.

When the hot water heater goes, wouldn’t it be nice to have a $10,000 to $15,000 emergency fund to bypass Visa and MasterCard? When “plastic” is used to catch the slack, balances are carried for multiple statement periods. And the rate on credit cards is notoriously high! Your $1500 water heater could end up costing $1800 with finance charges when it’s all said and done. Doing the math… $300 on a $1500… that’s an extra 20%! That’s $300 that could have been invested.

3. Increase your Deductible

With a working budget and an emergency fund, you can now take advantage of one of the easiest ways to cut auto insurance premiums… by increasing your deductible. When the insurance company takes on less risk, they charge a lower premium.

But always do the math. Let’s say you raise the deductible from $250 per incident to $500, you’re taking on $250 more risk. Let’s say this reduces your premium by $300. You have to determine whether taking on $250 more risk per incident is worth saving $50 a year. It sometimes comes down to the value of the car and how long you can go without making a claim.

One big mistake is when a person takes no collision coverage, because he owns the car. This is totally about the value of the car. Say the car is worth $5000, and cutting collision saves $500. $5000 divided by $500 per year would suggest that this individual believes he will go 10 years without a claim. And that he has $5000 in an emergency fund to replace the car in the event it is totaled.

Keep these three things in mind. But no matter what, make a budget. And follow it! Call me if I can help. It is my area of expertise.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, call me and leave a message or send a text to 570-731-0425.