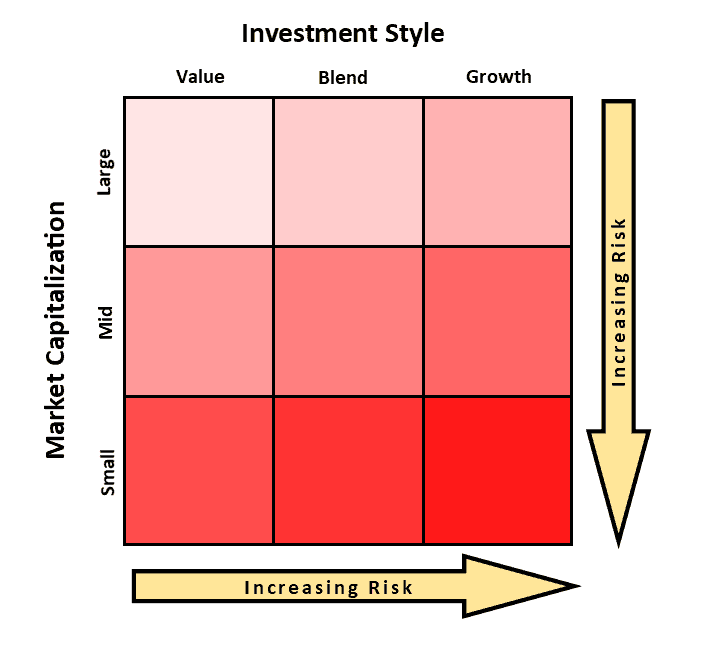

Dave Ramsey’s asset allocation can work well for new investors. However, I no longer follow his recommended asset allocation. He does not include the bond market to smooth the ups and downs of the market. Plus, there is a fair amount of overlap in his recommended asset allocations. Dave also suggests using his SmartVestor Pro. (I assume Ramsey gets an affiliate fee.)

Below is my current asset allocation. It is based on Jack Bogle’s advice. I have written about other popular asset allocations on this site.

Whichever you choose, diversification and steady dollar-cost-averaging is the key to building wealth in the long-term.

Current targets for my Roth IRA…

- 64% Total US Stock Market Index (VTSAX/VTI)

- 16% Total International Stock Index (VTIAX/VXUS)

- 20% Total Bond Market Index (VBTLX/BND)

Back in January 2019, I switched to my current asset allocation in both our Vanguard Roth IRAs, because I’m nearing retirement. Although Dave promotes his SmartVestor network of professional investment advisors pretty heavily, I advocate a DIY approach. It’s way cheaper and can increase your long-term balances by hundreds of thousands of dollars. Over 80% of the pros don’t beat the market, and the market is cheap and easy to make with index funds.

Two of the best books I have read are The Bogleheads Guide to Investing and The Bogleheads Guide to the 3-Fund Portfolio. I use the Vanguard funds VTSAX, VTIAX, and VBTLX. The ETFs that mirror these mutual funds are VTI, VXUS, and BND until you have enough to invest in the mutual funds.

More recently I read The Simple Path to Wealth by JL Collins. I like this content. Jim is a fan of Vanguard (especially VTSAX) and recommends broad-based index funds for an inexpensive set it and forget it approach.

Although I am neither a broker (I don’t sell financial products) nor a an Investment Advisor (yet), I am (was) a Ramsey Solutions Master Financial Coach. Combined with my life experience, I am able to help most people with most typical middle class money problems – budgeting, investing the surplus, and avoiding debt.

Others report that brokers (still) don’t really have to act with fiduciary responsibility (the SEC has been criticized for weakening regulations). Brokers merely have to sell investments that are “suitable” for clients, but not necessarily in the “best interest” of the clients. This is one of the reasons I had never sought financial licensing to sell investment products.

However, I am studying to write the Series 65 Exam to possibly start a registered investment advisor firm or even a capital investing form.

Presently, as a financial coach, I am trained to primarily:

- Listen and understand the client’s situation.

- Provide information.

- Inject hope.

I do not advise paying an investment advisor unless you want a total hands-off approach and don’t mind losing out on hundreds of thousands in fees. Just a 1% fee is enough to sack over $300,000 in lifetime returns. When you consider that about 80% of mutual fund professionals fail to match the market, it’s no surprise that JL Collins’ advice to use borad-based index funds is gaining in popularity.