Many have heard of bull markets and bear markets. You may even know that a bull market means that stock prices are an upward trend and that a bear market means that stock prices are on a downward trend. But how many know where the bull and bear references come from?

When a bull attacks, it moves its head (and horns) in an upward arcing motion. Kinda like the upward trend of an increasing stock market.

And when the bear attacks, it strikes its prey with a downward swiping motion with its powerful front paws. Kinda like a sharp drop of a market correction.

What should you do in bull and bear markets?

I was trained do the same for either a bull market or a bear market – dollar cost averaging (DCA). In fact, the Bogleheads Philosophy reports that DCA is not only less stressful than trying to time the market. It nearly matches timing the market with lump sum investments from a cash portfolio!

The novice urge is to sell the dip and wait for the market to look like it’s getting stronger again. This “buy high high, sell low” behavior is a hallmark of novice investing. And it’s a losing strategy.

I do not “play” the stock market. My wife and I have jobs, so we buy and hold. If our job outlook ever looked tenuous, we’d push pause on the investing to augment our cash positions. But just don’t try to “play” the market. The market moves randomly in the short-term and it will win. Statistics indicate that a scant few day traders earn a living trading. In fact, so-called technical traders (posing in front of rented private jets) make more money selling their courses than they actually make investing! (The courses you find here are free.)

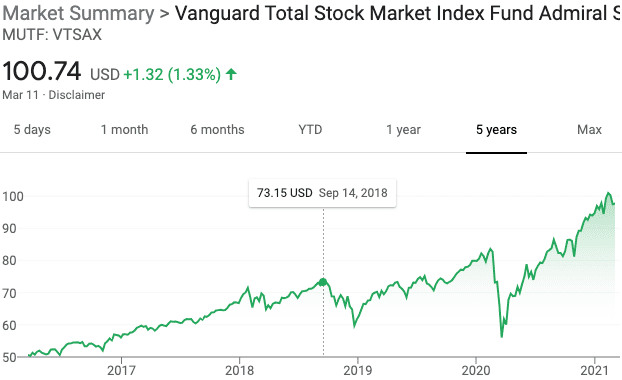

So we do DCA for both tax-favored retirement accounts and our taxed stock portfolio accounts. If I can’t hold a stock for a period of three to five years, I don’t invest in it. And we hold indefinitely (or at least until retirement) in the case of the broad market index funds (VTSAX, for example) that make up our retirement accounts.

What is dollar cost averaging?

Dollar-cost averaging means investing the same amount every month, pay period, or week. As I mentioned above, in The Bogleheads’ Guide to Investing, retroactive studies indicate that DCA at least matches trying to time bull and bear markets with lump sums. The reason many consider DCA to be better is that it is just plain easy and less stressful. No charts to read. No watching the markets every day. That’s nerve-racking!

So DCA is more of a set-it and forget it approach when going long using broad band index funds. If a person can invest $6000 a year in a Roth IRA, they could send $500 a month, $230.77 per pay period, or $115.38 a week to their Roth IRA. I prefer weekly, because it smoothes out our monthly cash flow.

Is there anything else?

My final step (ongoing really) is to rebalance my asset allocation periodically. For me that’s, quarterly. There is no charge for buying and selling Vanguard securities within our Vanguard accounts. You would need to check with an employer-sponsored 401(k) or 403(b) about rebalancing.

Rebalancing asset allocation ensure that we are buying low and selling high.

And the M1 Finance pies also have a rebalance feature. It’s as easy as the touch of a button. But remember, do not invest in individual stocks at until after tax-favored retirements accounts are maximized. And never buy individual stocks with money your may need. This is also be a long position with quarterly rebalancing. We invest “Foolishly.” (i.e., we have found the Motley Fool Stock Advisor to be a valuable service.)

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, send an email to mark@marknoldy.com.