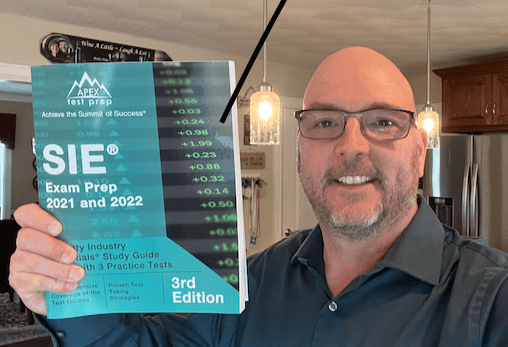

So my study guide for the SIE Exam arrived this week. I hope I picked a good one. This is the first step toward becoming a bona fide financial industries professional.

What is the SIE Exam and why am I taking it?

The Security Industry Essentials Exam is the first step toward a career as an Investment Adviser Representative (IAR). I decided to take the SIE Exam to learn more about personal finances and prepare for my post-teaching career. Also, earning industry licenses should boost my authority on the topic of personal finances for this blog. Eventually, I want to lose the “for educational purposes” caveat at the close of every blog post!

After this, I will likely take the Series 65, the Uniform Investment Advisor Law Exam. With the Series 65 Exam, the successful candidate is qualified to register as an Investment Adviser Representative (IAR), not a registered representative (RR). This means providing investment analysis and advice to clients based on needs.

The SIE Exam and Series 65 are the only exams a person can take without being “sponsored.” I’m talking about the Series 7 and 66. Although I could start an RIA firm (Registered Investment Advisor) without taking Series 7 and 66. They are more for RRs (which are stock brokers) than IARs. Given the increase in the latter (and decrease in the former), I think I have been on the right path. I do not want to sell securities for a brokerage firm.

An RIA firm is different than a broker-dealer. The RIA firm employs IARs who operate as fiduciaries. This means acting in the “best interest” of clients. Broker-dealers merely have to provide “suitable” advice, which often means recommending commissionable activity. Think of the Fisher Investments TV commercials, “We do better when our clients do better.”

I may take also take the PA life insurance exam. Many businesses seem to be listing this as a prerequisite for employment, and I was previously certified. But I am not as certain on this. I don’t really want to sell life insurance.

What is on the SIE Exam?

From what I have gleaned, this first test assesses rudimentary essentials. It contains just 75 questions on:

- knowledge of capital markets (12 questions)

- understanding of products and their risks (33 questions)

- understanding trading customer accounts and prohibited activities (23 questions), and

- overview of the regulatory framework (7 questions)

The middle two sections seem to contain the “meat and potatoes.” Products and their risks is okay, but trading accounts and prohibited activities will take some studying.

What’s in the study guide?

I purchased the the Apex study guide which has 3 practice tests in it. This weekend, I plan to take the first test cold – no prep! After this, I will block my study schedule and determine when to write the exam (late April is looking ideal!). I’ll see whether being a finance major 30+ years ago helps!

FINRA is the Financial Industry Regulatory Authority. This private self-regulatory group administers the qualification exams like SIE and Series 65. There are numerous other exams. The area in which a candidate wants to practice determines the qualification exam.

Although FINRA has lobbied Congress for complete regulatory authority over RIA firms, the states and the SEC have maintained control. RIA firms seem to be happy with this.

What’s next?

Like I said, my next likely goal is to take the Series 65 Exam. I would like to register as an IAR. This involves completing forms in the state where one practices and possibly registering with the SEC (Securities and Exchange Commission. (That’s the federal authority.)

Small advisors – less than $25 million with assets under management (AUM) – may not register with the SEC.

Mid-sized advisors ($25-$100 million AUM) must be registered depending on the state in which they practice. In New York and Wyoming, registration is required. So if you’re registered in the state (PA for me), you are not required to register with the SEC (unless you work for an RIA firm).

Large advisors (over $110 million AUM) must register with the SEC. But there is a registration buffer from $90 million to $110 million AUM.

Having stated all that, if you work for an RIA firm, the you are required to register with the SEC regardless of AUM.

Then it’s back to FINRA to create an account with the Investment Advisor Registration Depository (IARD).

This is all in the interest of protecting clients from bad actors. Although some believe that FINRA is more interested in registered representative (that’s the stock brokers) than register investment advisers (RIAs). Remember that stock brokers work on commissions and only need to provide advice that is “suitable,” while RIAs act as fiduciaries. Fiduciaries provide advice that is in the clients’ best interests. That’s kinda like talking with the doctor and asking what would you do if it were your health.

Sorry for the “web log” type post. (Incidentally, ‘web log’ is where the word ‘blog’ comes from.) As I researched this, it became helpful for me to write it down.

Next week, I’d like to record my first YouTube video walking people through how to craft a personal budget using an Excel spreadsheet.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, send an email to mark@marknoldy.com.