When I was younger, I just thought people retired when they turned 65, and the government paid for everything. The older I get, the more I realize that the government — which isn’t exactly known for managing money well — is not going to take care of me in my golden years.

Never Too Early or Too Late

So if the government isn’t going to save the day, what’s a person to do? We need to get to Baby Step 4. Once here, you are debt free (except your mortgage) and have 3-6 months expenses in a money market emergency fund.

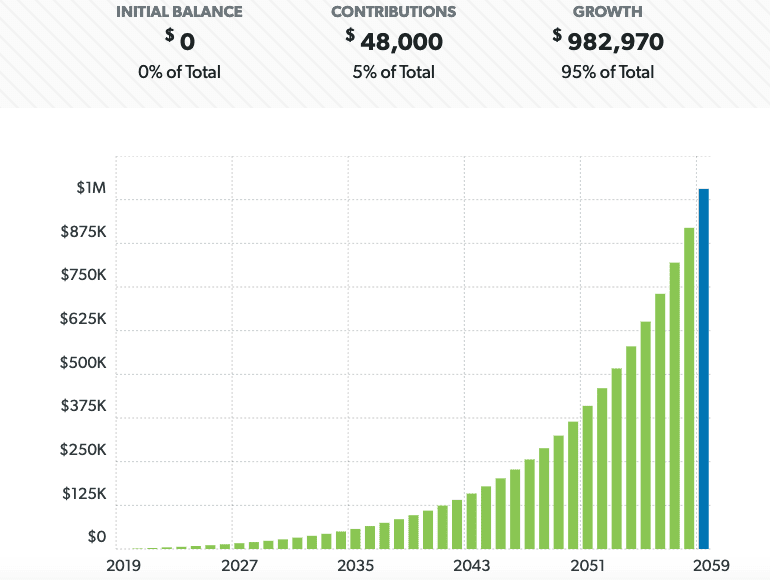

No matter where you are, you can start investing. Someone in his or her late teens or early 20s has an advantage over a 30- or 40-something. But the sooner you start, the less you’ll need to invest each month. In fact, just $100 a month invested from age 20 to age 60 makes you a millionaire.

Now it’s time to have a Dream Meeting with your spouse, significant other, or accountability partner. For example, my wife and I know we are retiring to Garden City Beach, SC. We have a picture of the ocean from the balcony of the condo we plan to live in. (See actual photo above – not the golden eggs…)

Frequent talking about our dreams keeps us inspired to stay on track toward our number (keep reading). Because we are coming from behind, we really need to stay focused to hit that number. This means no stupid tax!

So what’s this number you’re reading so much about?

Retirement is a Financial Number

So what’s your number? Maybe you’ve seen that ING commercial with the people carrying around a large orange number under one arm. In the old days, experts like Dave Ramsey used to say divide your salary by 0.08. This number assumes you can continue netting 8% per year on your nest egg, effectively living off the interest.

Then you reverse engineer an investment plan back to the present that would get you there. This isn’t too hard when a good coach shows you how to use an investment calculator. But that’s not the only way…

Chris Hogan and his team of developers have taken all the computations out of it with the Retire Inspired Quotient, or R:IQ for short. Click here for that tool. This is a free tool that asks some simple questions about your lifestyle, current income, time to retirement, and amount already invested.

First, your R:IQ is revealed. This is the Financial Number I’m talking about. More importantly, the tool also lets you know how much you should be investing monthly right now.

Use the site to reach out to a SmartVestor Pro, or talk with your financial coach for recommendations on how to screen mutual funds or ETFs.

If you plan well, you will have more time and money than ever before at retirement!