United States debt clock is at over $28 trillion. And that’s not even the worst part knowing that U.S. unfunded liabilities are over $162 trillion. That’s the money the government knows it will have to pay at some point in the future. So have you ever heard someone say, “Why don’t they just tax the rich?”

The rich can’t pay off the national debt. First, they didn’t spend the money that caused the debt. Second, if the government could confiscate 100% of all billionaires’ wealth, the national debt number wouldn’t even move one decimal place!

Rich people don’t work for money. Money works for them. They don’t pay income tax. Understanding the three types of income helped me overcome my ignorance.

Earned Income

This is most of us. We trade time for money. W2 income earners pay more income taxes than anybody except the self-employed. One reason is because self-employed individuals pay both halves of their payroll taxes — all 15.3%, not just the wage earners’ 7.65%. The employer pays their other half.

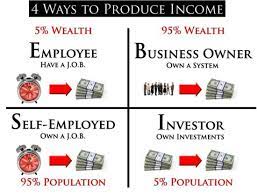

According to Robert Kiyosaki’s second book Cash Flow Quadrant, about 95% of us earn 5% of the money as employees and self-employed. Meanwhile, 5% control 95% of wealth.

BTW… Kiyosaki says J.O.B. means Just Over Broke!

Portfolio Income

Investors pay the second most in taxes. This is because the capital gains on portfolio income is taxed way less than earned income. Investopedia.com reports that 2020 dividend tax rates vary based on taxable income and how long the stock has been held.

These incentives encourage investment in the markets. Employees are investing more thanks to apps like M1 Finance, but institutional investors, as they’re called, dominate the markets.

Passive Income

Passive income supplies money for the rich. They own big businesses and use the profit to invest in real assets – oil fields, rental units, golf courses, precious metals, and even cryptocurrency. And businesses and real estate have the most tax advantages. This provides incentives for people to help the government meet its objectives. Providing housing is but one such example.

Many rich people are criticized for paying less in taxes than their employees. But their employees have earned income. Saying “Tax the rich,” only shows an ignorance of the 3 types of income.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, call me and leave a message or send a text to 570-731-0425.