On Monday, I showed you how to determine your net worth. Now you may wonder, Is this good? Enter the wealth index…

The wealth index is a tool used to measure personal net worth against others in your age/income cohort? In The Millionaire Next Door, the authors (Thomas J. Stanley and William D. Danko) explain what they call the net worth index.

The Net Worth Index

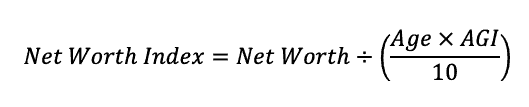

Based on the millionaires that the authors studied, they arrived at the following formula to measure relative standing among their income/age cohort.

Multiply your age times your adjusted gross income (AGI). AGI is a line item on your tax return. Then divide that product by by 10. (If you’re married, use the age of the highest income earner in the household along with joint AGI.)

Next divide that quotient into your net worth figure from Monday.

Interpretation

Prodigious Accumulator of Wealth (PAW)

If your net worth index is more than 2, congratulations! You are a prodigious accumulator of wealth, or a PAW. You are in the top quartile among others in your income/age cohort. You typically save 15% of your income and have enough “go to hell money” (a.k.a. F.U. Money) to quit working for 10 years or more.

Under Accumulator of Wealth (UAW)

If your net worth index is less than 0.5, then you’re an under accumulator of wealth, or a UAW. You are in the bottom quartile of your income/age cohort. These individuals typically live above their means, emphasizing consumption.

Average Accumulator of Wealth (AAW)

In between? (0.5 to 1.99) You are an average accumulator of wealth, or AAW. This is the middle 50% of all people in your income/age cohort.

Analysis

Having gotten a late start, I am in the middle 50%, but we started as UAWs ten years ago. We track this figure on our budget spreadsheet, and it improves a little each month. Naturally, my goal – and the goal of most people reading this – is to become a PAW.

If you’re like me, take comfort in knowing that your situation is not fixed. Having a growth mindset is necessary to change. You will have to abandon the myths you may have regarding wealth. As Dave Ramsey says, we first have to live like no else, so later we can live like no one else.

PAW Checklist

According to The Millionaire Next Door, PAWs usually don’t “look rich.” That’s actually the hallmark of many UAWs who don’t always act their wage.

Homes

PAWs usually live in modest homes, big enough to meet their needs, and small enough to be able to accumulate wealth. And most PAWs have paid-for homes which is one thing that contributes to their high net worth index.

By contrast, UAWs are often house-poor, living in homes that exceed their needs in addition to the recommended 25%-35% of net income.

Cars

PAWs typically drive paid-for domestic automobiles. They know that borrowing money to buy a car is like borrowing to invest in a stock you know will go down in value. Few have the newest model. And just a few lease vehicles.

UAWs often drive new cars. They are much more likely to lease and to drive imports.

Investments

PAWs have long-term investments in equities, corporate debentures, and real estate. These folks maximize the use of tax-favored retirement vehicles like Roth IRAs, IRAs, 401(k)s, 403(b)s, Keoghs, or 457s.

UAWs have little to show for their years of toil due to living a consumptive lifestyle. It’s tough to invest when all your money is going out the door with someone else’s name on it in order to maintain a “look rich” lifestyle.

Career

A disproportionately larger number of PAWs are self-employed. And those who work in high-income jobs live on less than they earn.

Most UAWs trade time for money at a job. (Me!!) Often when they find a new job with a higher salary, they increase consumption. Celebrating a $500 a month raise by buying a $500 a month car does nothing to increase wealth.

Many UAWs also work past retirement age. They have not accumulated enough wealth to enjoy their golden years.

Other Observations

According to the book, some UAWs “look rich” because they live on economic outpatient care, or EOC. According to their research, females are most often the UAW recipients of EOC from PAW parents.

Finally, when asked the number one key to acquiring wealth, millionaires said that avoiding debt was central to their wealth-building.

PAWs also have a written budget, probably making them the lion’s share of the 30% of Americans who have a budget.

Read the book. Besides cars and houses, the book draws PAW/UAW comparisons on clothing, jewelry, watches, vacations, and more.