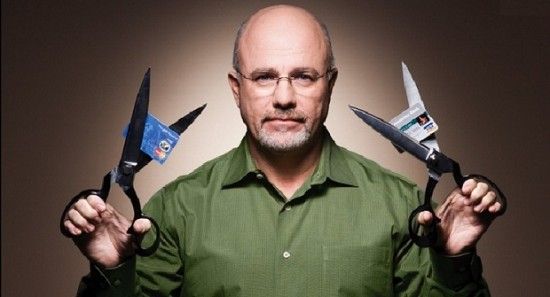

Made famous by one of my favorite personal finance gurus, the plasectomy means cutting up your credit cards in order to prevent borrowing and start paying cash for stuff.

Many people need to undergo the plasectomy. But some individuals might be able to use a credit card as a purchasing tool and not as a financing tool.

My wife and I only use our debit card at the ATM at our local bank, but we use our credit card as cash. Can you?

Dave’s Rules

One area where we bend Dave Ramsey’s rules is credit card use. I probably should go to using only our debit card as I move forward with my financial coaching business, but that is unlikely. Using a credit card provides many benefits and protections.

Presently, we use credit cards. Not for emergencies. Not for stuff we can pay cash for. Not for stuff we want but can’t afford. We use a credit card with online merchants to create a buffer between the online merchants and our checking account.

I know VISA guarantees purchase protection. But if my VISA debit card were to be compromised, I would still have to contact my bank, and then wait for money to be put back in my checking account.

This would only be a problem if we lived paycheck to paycheck. But it’s our money, and we should not have to wait for someone else’s criminal inclinations to be established to avoid paying for bogus charges.

For example, my Discover card was once compromised. I contacted Discover to say that I did not make a purchase, and they removed the disputed charge instantly while they investigated. (Actually, Discover Financial Services stopped it before I even called. I get text messages every time my card is used, and they somehow knew the purchase was fraudulent.) No worries. No chasing anyone to get the money back.

I’m a conservative, so I know that guns don’t kill people… people kill people. Similarly, I have have to believe that credit cards don’t cause debt… cardholders’ behaviors cause debt.

A plasectomy (i.e., cutting up credit cards) is kind of like having Roux-en-Y surgery (cutting up your insides). Both procedures treat symptoms (being broke/fat), not the root cause of the problem (spending/eating disorder).

Points Don’t Make You Rich

It’s true. Discover points will never make us rich, but they do help us enjoy some free middle-class luxuries. I realize that multi-millionaires didn’t achieve their millionaire status from their Discover Cash Back Bonus, their Capital One Miles, and so forth.

Discover Card Cash Back Bonus will not make you rich. Share on XHowever, using our Discover card to pay for things we would be buying anyway (utilities, groceries, etc.), my wife and I are able to enjoy a free meal out every month. We use an Amazon Prime Chase Visa at Amazon, Audible, Woot, and Zappos (all Amazon businesses). I use an AppleCard for Apple Store purchases, iTunes, and iCloud storage. All are budget items, so these are paid off monthly. And all provide incidental freebies.

Caution

The cautionary tale speaks to the root cause of being broke — behavior. Dave is right about one thing… Winning with money is more about behavior than head knowledge. For the typical person, this usually means cutting up credit cards to prevent their use.

We were unusual as we chose to focus on the root cause of our consumer debts, our behavior. This would not have been possible without having a plan for our income, namely a budget.

If it is truly about behavior, not head knowledge, then learning to control your spending with a budget may be the path that you follow.

But if you cannot trust yourself to say no to stuff you wanna buy with money you don’t have, then you do need a plasectomy.

Improve FICO

I know we’re not supposed to worship at the altar of FICO, but I have four daughters. I have borrowed (or will be borrowing) money for them to attend post-secondary institutions. Due to my late start on the road to financial peace (middle of the 2nd quarter), I had no college tuition saved for them. Since borrowing relies heavily on the FICO score, using credit cards in the way we use them keeps our FICO well above 800.

Regardless of what Dave says, until we are financially independent, we will need a good credit score. If you use credit cards for things that you would have used cash for anyway (e.g., groceries, utilities, etc.) then you can substantially boost your credit score.

As Always…

Thanks for reading! I hope this information provides food for thought. Remember that I am not a certified financial planner, a certified public accountant, a licensed real estate agent, etc. My content is for educational purposes. I am a math educator who happens to have a finance degree. Like they say, never take financial advice from a math teacher! (Do they really say that?)

But you should spend less than you earn, invest the difference, and stay out of debt!

I would so appreciate your sharing my content with anyone you feel could benefit. And if you would like a free exploratory conversation or just want to shoot the breeze about personal finances, call me and leave a message or send a text to 570-731-0425.