All I remember were the feelings of shame and embarrassment. What were people going to think of me? How would my daughters react? I felt like Mike Tyson punched me in the chest…

In July 2006, my life turned upside down. After 4 years of courting through college, 15 years of marriage and four children, I thought life was good. But I received a crushing blow. My (now ex-) wife announced she was walking away from the responsibilities of marriage and motherhood. I did not see that coming, but evidently my life was a house of cards. Maybe you’ve been here…

Thinking it was all my fault (because that’s what I was told), I spent many months and invested a metric crap ton of money — money I didn’t have — on several marriage-saving programs and divorce-busting gurus. I finally talked to my pastor. That was free, and he echoed what the counselors had told me… it sounds like you married a walkaway wife going through a mid-life crisis.

Fast Forward 6 Months…

Turns out I wasn’t such a bad person. After about 3-4 months, I gained clarity on the walkaway wife syndrome, knew my old life was over, and I knew I had to move on. But now I was deep in debt not just from my recent journey of self-discovery, but more so from the credit card debts my ex had run up during her mid-life crisis. And there was more spending on the horizon…

Although my divorce attorney is a very generous family friend, it was still more money I didn’t have. But it was the gauntlet I needed to run…

Once my divorce was final, I was arm-pit deep in quicksand. You may even know the feeling. With nearly $20,000 of divorce-inherited debt and numerous other bills hanging over my head, I found hope.

Next Chapter…

Through the discomfort of the first quarter of my financial game ending, I grew. Best of all, I remarried two years after separating. My wife had also sought wise counsel. She had come through her own time of discomfort (similar to mine) around the same time. The stars were in perfect alignment!

In addition to self-help courses, counselors, and legal fees, my wife had also inherited extensive debts from her previous relationship…

The Tidewater Surges…

One night while channel surfing during the winter of 2008-09, we came across The Dave Ramsey Show on Fox Business Network. We became curious about the Baby Steps he kept mentioning. So we bought his book The Total Money Makeover and read it cover-to-cover multiple times. We then did Financial Peace University (FPU).

Then I learned that Dave Ramsey also had the 3rd most listened-to radio program right behind Rush Limbaugh and Sean Hannity. I listened the entire summer of 2009. I got to the point where I knew what Dave was going to tell the callers. After a year of total immersion, we were on the right path – a biblical path – with our personal finances.

I created an Excel workbook (spreadsheet) like the good nerd I am. We are still using that same Excel workbook 16 years later, adding a new worksheet each month for our budget. I also created a worksheet in the workbook to track our original debt snowball. This Excel workbook is worth a fortune to us. Beyond being the most important tool in our turnaround, it documents our journey.

Fast forward 10 years…

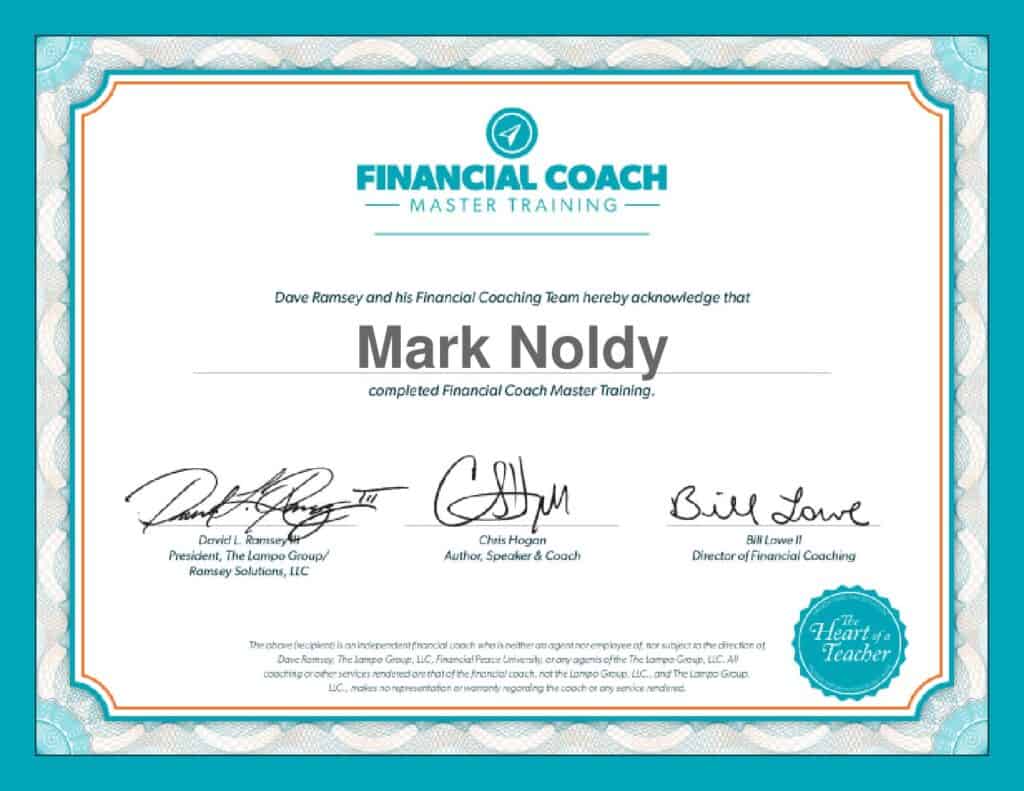

In 2019, I learned that Ramsey Solutions offered financial coach master training. So I jumped in with both feet. I learned that coaches are just a few steps further along than those they help…

In my previous life, I had been one or two missed paychecks from bankruptcy. During my training, I discovered I was part of the 78% of Americans who were living paycheck to paycheck. What an eye opener! It wasn’t only me.

It took my getting nervous, because I have more years behind me than I have ahead of me. What was I going to do? How was I going to make up for lost time? I was committed to becoming not only the best math teacher I could be, but we also decided we needed to help others climb the same hill we were climbing.

We are still climbing and working the Baby Steps, but we are headed in the right direction. There is a simple path to financial independence. Not easy, but simple. And we no help others get through the messy middle and on the right track to their own financial peace. Helping others helps us. It was Joubert who said, “To teach is to learn twice.”

Reaching out is the first step. Start with a free exploratory conversation.

I can be reached at 570-731-0425 (leave a message/text) or at mark@marknoldy.com.